- #Moon invoice tutorial how to#

- #Moon invoice tutorial pdf#

- #Moon invoice tutorial full#

- #Moon invoice tutorial software#

- #Moon invoice tutorial professional#

#Moon invoice tutorial professional#

It’s professional yet free, and there is no need to sign-up using a credit card, so why not opt for the TRY-BEFORE-YOU-BUY service. A kind of online receipt maker, your business always wanted to keep invoices and payments on the go.

#Moon invoice tutorial pdf#

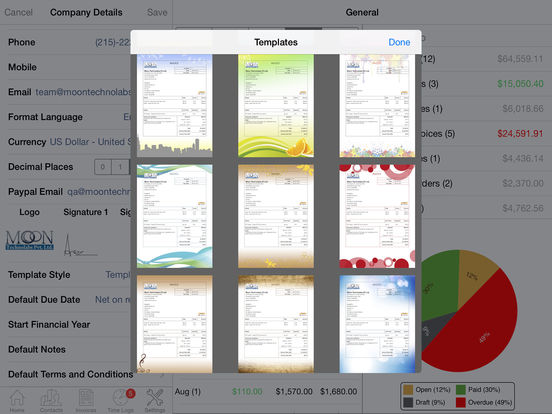

Users can utilize the readymade PDF templates for creating easy invoices and estimates.

#Moon invoice tutorial software#

Our easy invoices template maker software helps you create customized invoices by adding your business logo and name. It takes care of your organization’s complete billing cycle, including purchase order and credit note elements. The Moon Invoice estimates and expenses maker app lets you feel the edge and comfort of the Invoicing era. The Moon Invoice billing software is a simple and secure invoice app for small & medium businesses.

However, with a recurring invoice, there is no searching through past payments on a single invoice there's one payment per invoice, which makes tracking easier.Send professional & easy invoices from your desktop. If you are accepting multiple payments or instalments for your invoices, you may want to create a recurring invoice instead. If you want to accept multiple payments on one regular invoice, you can-it's up to you. The only difference is that your invoice won’t be marked as Paid, as there will be a balance remaining. You can find the steps to record an invoice payment in this Help Center article.

#Moon invoice tutorial full#

Recording a partial payment is much like recording a full payment. If an invoice is not paid in full by the due date, its status will change from Partial to Overdue. You can include payment terms in the Notes field when you create an invoice, indicating to your customer that they should pay a certain amount by a particular date, and the remainder by the due date. Partial paymentsĬustomers may choose to pay only part of the total invoice amount. This method allows you to reduce the prepayment account as you clear your receivables.

#Moon invoice tutorial how to#

How to record a prepayment on a future invoiceįollow these steps when you’re ready to record the prepayment against an invoice: Choose a customer from the dropdown menu.Click the dropdown arrow on the far right of the deposit transaction, and select Edit more details.If you chose to create a single Customer Prepayments and Customer Credits account, you can add a customer to the transaction, to indicate which customer this deposit is coming from. This will increase the prepayment account by the amount of the deposit. Find the deposit (income transaction), and categorize it to your newly created Customer Prepayments and Customer Credits account.Next, we’ll use the new Customer Prepayments and Customer Credits account as the category for your deposit transaction: Or, you can create a Customer Prepayments and Customer Credits account for each customer, and use these accounts to categorize the deposits that you receive. You have two options here you can create a single Customer Prepayments and Customer Credits account to categorize all deposits you receive from customers. Fill in the account details, then click Save.Scroll down to Customer Prepayments and Customer Credits, and click Add a new account.At the top of the page, select the Liabilities and Credit Cards tab.From the left navigation menu, select Accounting > Chart of Accounts.

The first step is to create your customer prepayment account: How to account for receiving deposits or prepayments We'll walk you through how you can handle this type of arrangement, and similar transactions. If you work with clients on an ongoing basis, or if you're beginning a large project, you may want to accept a deposit or prepayment from your customer.

0 kommentar(er)

0 kommentar(er)